Top section

Top section

◆ Refi deal came as issuer prepares IPO ◆ Deal extends the insurer's tier two curve by 10 years ◆ 'Strong bid' for Iberian FIG credit, says rival banker

◆ First two-part AT1 euro deal since Intesa's own in 2020 ◆ Funding establishes a flat curve ◆ Intesa, BNP Paribas both observe investors' reset spread threshold

◆ €500m 4NC3 EuGB deal priced inside fair value ◆ Greenium helps tighten spreads amid strong demand ◆ Landmark trade cements bank's ESG leadership, says treasurer

Data

Post-earnings issuance surged with borrowers taking advantage of tight spreads to raise more than $14bn in early February.

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

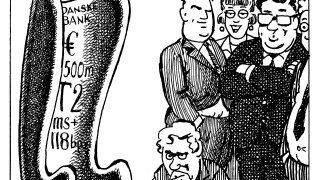

◆ Green label and capped size set up tight pricing ◆ Result is Danske's tightest tier two, beating Covid-era issuance ◆ Some first mover advantage gained

-

◆ First syndicated covered bond since early July almost four time covered ◆ Deal lands tight but still offers SSA pick-up ◆ RFPs circulate as pipeline builds

-

◆ Wendel proves the summer market isn't just for the big boys ◆ Trio of new issues show buoyant market for banks ◆ Private credit's threat to the investment grade bond and loan markets

-

Long tenors shine as US tariffs brushed aside and investors deploy cash ahead of autumn

-

◆ First Hong Kong dollar public bond from an international bank ◆ Broader investor access and larger size than PPs customary in the market ◆ Provides attractive funding

-

Senior funding there for the taking, covered bonds yet to take off — but conditions are great for all

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment