Top section

Top section

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

◆ 52bp reoffer equals Nordea’s multi-year record ◆ ‘Insane’ levels show FIG spread compression, rival banker said ◆ Buy-and-hold investors prioritised

Data

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

Late-week surge shows investors remain hungry for paper despite macro volatility

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

'Regulated layer one' initiative set to increase adoption

-

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

◆ Higher spread deals from established jurisdictions attract demand ◆ RLB Steiermark returns after more than two years away ◆ No premium needed for CCF's third of 2025

-

◆Rabo reenters euro senior market after more than a year away ◆ 'Pent-up demand' swells order book ◆ Green senior bail-ins down on 2024

-

◆ Peak orders enough to fill deal seven times ◆ Pricing through fair value ◆ Investors warming on Portugal

-

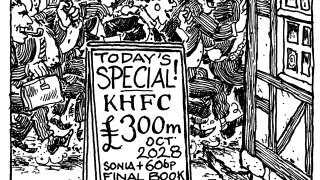

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment