Top section

Top section

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

◆ German state's last benchmark this year ◆ Tightest Länder seven year in 2025 ◆ International demand dominates book

-

Carlos Masip replaces Arnaud Louis, who joined IADB last month

-

◆ Land NRW and British Columbia eye euros ◆ Rentenbank going for dollars ◆ Too soon to pre-fund?

-

‘Long overdue’ upgrades not a surprise, but a relief, market participants say

-

More social deals to come, in dollars or euros

-

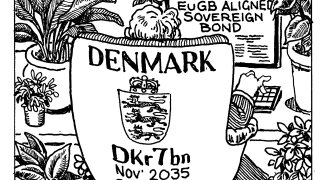

Sovereign achieved ‘significant milestone’ but market participants hope to see more

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment