Top section

Top section

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

◆ 52bp reoffer equals Nordea’s multi-year record ◆ ‘Insane’ levels show FIG spread compression, rival banker said ◆ Buy-and-hold investors prioritised

Data

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

Late-week surge shows investors remain hungry for paper despite macro volatility

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

◆ Value versus domestic curve debated ◆ Scarce Nordic tier two supply helped trade ◆ Nordic names 'still performing during volatility'

-

Subordinated deals make up a larger share of March's supply than usual

-

◆ MetLife returns to euros after January print ◆ Offers high single digit premium but comes flat to dollars ◆ BlackRock next with rare refi of its only non-dollar bond

-

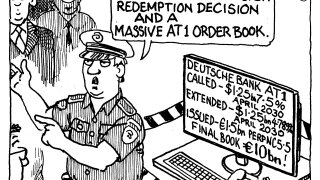

◆ New euro deal more than 6.5 times subscribed ◆ Comes one trading day after a call and non-call decision on two dollar AT1s ◆ Visible new issue premium helps attract orders

-

◆ Swedish issuer starts tight ◆ Deal lands close to recent SSA supply ◆ Seven year tenor offers investors something different

-

◆ Managing the go-no go call ◆ 'Granular' conversations on social label ◆ AT1 redemptions and offsets in balance sheet

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment