Top section

Top section

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

◆ 52bp reoffer equals Nordea’s multi-year record ◆ ‘Insane’ levels show FIG spread compression, rival banker said ◆ Buy-and-hold investors prioritised

Data

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

Late-week surge shows investors remain hungry for paper despite macro volatility

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

Odyssey Funding deal backed by Selina Finance's second lien mortgages could prompt copycats

-

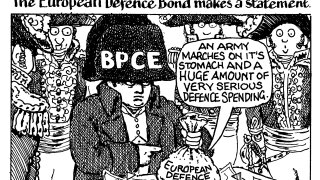

If you want peace, financially prepare for war

-

◆ Novel deal first of a kind from a non-SSA issuer ◆ Delivers 'political message' in readiness for defence financing ◆ Bankers debate whether issuer paid 'generous' concession

-

◆ Deal is first since French PM called confidence vote ◆ Some concession left on top of wider secondary levels ◆ Bankers call French covered paper 'attractive'

-

SocGen gets good execution, RCI Banque coming next, then CIF

-

◆ Four years is the 'sweet spot' ◆ Existing curve ignored during pricing ◆ Slim premium paid over recent deals

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment