For years, banks have been hellbent on introducing new types of labels to their bond issuance.

This has led to several eye-catching one-off deals but little else. Everything from women in business bonds to pre-Olympics sports economy bonds have arrived with much fanfare before disappearing without trace.

But in the European Defence Bond, the market might have just found a new label that sticks. Like a green bond it ring-fences the use of proceeds and bears the promise of annual allocation reports.

Moreover, it will fund something that there is a clear, long-term need to finance that requires a great deal of capital.

Financing the defence of Europe has become a hot topic this year.

The EU has created its €150bn Security Action for Europe (SAFE) plan, a new multilateral development bank to support Nato members and their close allies in defence procurement is in gestation, and European governments have pledged much higher defence spending — much of which is to be financed in the bond market — all since US president Donald Trump berated Nato members for neglecting the topic.

Europe's banks will also have a role to play in mobilising funds for the defence industry.

Unlike previous attempts at launching new bond labels, there is an existential crisis at the heart of the European Defence Bond tag.

The causes for green bonds are easy to understand: if we don’t tackle climate change, the seas and temperatures rise causing catastrophe to our way of life.

Similarly, if Europe doesn’t steel itself against hostile forces, the outcome might be similarly disatrous.

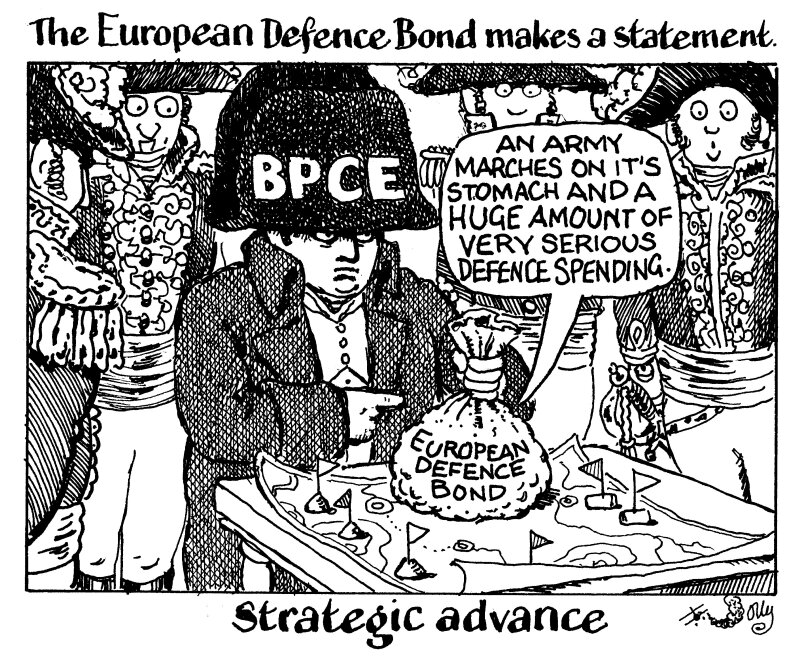

And the scale of the funding needed — defence is an expensive business — means that this week's inaugural deal from BPCE can be no one-off.

As European Commission president Ursula von der Leyen put it earlier this year, the question is no longer whether European security is under threat but whether the continent is ready to act decisively and with the necessary speed and ambition.

With €2.8bn of orders stacked up behind BPCE’s €750m bond, which was said to have offered a 7bp-15bp new issue premium, investors have shown a desire to back the new European Defence Bond label.

Admittedly, those numbers hardly spoke of a blowout. But then bringing a French deal in a market worried afresh this week about the country's budget, government and economy hardly means it was conducted in laboratory conditions, which it makes it hard to draw too many conclusions as to the success of the format.

It also was not immediately clear what the proceeds of this bond will fund that BPCE was not going to lend to anyway.

Nonetheless, other issuers are understood to have taken note and made their own enquiries about the label.

If there is a time to launch defence-labelled bonds, that time is now — and not when European defence industry urgently needs to start beating ploughshares into swords.

Europe is ramping up defence spending and the European Defence Bond label may prove a useful tool.