Top section

Top section

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

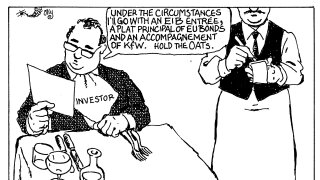

Macron's vision of a sovereign EU appeared closer in bond markets this week, thanks to French political discord

-

Several public sector borrowers brought well received deals this week

-

Borrowers remain distinct but funding officials will sit together

-

Fee pool dries up as banks take to tech to find candidates but industry figures warn that LinkedIn cannot do it all

-

Hong Kong dollar issuance stays hot, while Middle East names add to a steady run in private placements

-

◆ Deal draws substantial order book ◆ LCR categorisation a pull for investors ◆ Sustainable label draws 'prestigious names'

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment