Top section

Top section

◆ New deal to replace AT1 from October 2020 ◆ Resistance to tight pricing building ◆ Market watches the 300bp euro reset barrier

Market participants debate 300bp 'soft barrier' for AT1 resets as banks probe ever-improving cost of capital

◆ Market conditions made going ahead an "easy decision" ◆ Two-year FRN priced flat to fair value ◆ Floaters' secondary liquidity debated

Data

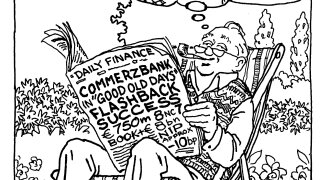

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Late-week surge shows investors remain hungry for paper despite macro volatility

Classic January new issue volumes as barely there premiums come into vogue but US banks threaten to crowd out Europeans

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

Senior market 'in good shape' with plentiful of liquidity

-

◆ Risky debt offerings unhindered by French political worries ◆ Groupama prices debut deeply subordinated capital at 'better than anticipated' level ◆ La Mondiale sees result as good omen for its RT1

-

◆ Transaction set to price through BTPs ◆ Social format offers ‘something a bit unique’ ◆ Aareal Bank joins covered pipeline

-

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure

-

◆ Market takes surprise election results in stride ◆ Insurance companies leading with plans to raise deeply subordinated debt ◆ Bank capital and senior deals in euros and dollars also on the cards

-

◆ MPS to launch a new covered format ◆ Infrequent and higher yielding issuer suggests market is 'stable and open' after French elections ◆ A 'few other' covereds are in the pipeline

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment