Top section

Top section

CEB plunges into Sofr FRNs with $500m debut

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Lloyds lifts green senior euros after Yankee foray

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

Crédit Agricole differentiates from competition with 'untested' 12 year SNP bullet

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Sub-sections

-

Sterling deal securitizes two data centres in Slough

-

International interest for German paper has grown

-

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

-

◆ Issuer's first green benchmark in 2026 ◆ Blended premium estimated ◆ Central bank/official institution allocations 'notable and high' for green label

-

Bankers insist sustainability-linked loans are here to stay

-

◆ Demand sticky despite tight pricing ◆ Trade performing in secondary ◆ Tight senior/sub spread spotted

-

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

-

Hyperscaler earnings could become a crucial date for issuance funding calendars

-

Cologix taps private ABS for latest trade

-

Chemical sector's growing uncompetitiveness a problem when it comes to attracting investment in the capital markets

-

Canada throwing full weight behind plan for new multilateral lender for defence funding

-

Second Canadian lender to declare official support for embryonic SSA issuer as government takes lead on establishing new entity

-

Markets may not be shut for too long, and African sovereigns have managed debt well

-

Sovereign pays at least 25bp of concession but points to healthy demand after broader spread widening

-

The dollar market is going to be an unreliable friend for some time

-

Sovereign bonds have suffered a brutal eight days, like other emerging markets

-

◆ Paper is a 'must buy' for some accounts ◆ Pricing breaks trend and tightens 3bp ◆ Orders total over €40bn

-

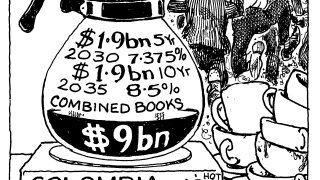

AfDB's hybrid is main comparable for pricing CAF's benchmark dollar debut but roadshow feedback also holds key

-

Investors and bankers grapple with 24% fall in Bitcoin since deal was rated

-

Investment banking travel was a relentless grind, not gold card access to global glamour

-

Books were nearly three times the issue size

-

Eight banks provided loan facility to company

-

Vaccine bond programme to issue $1.5bn this year but needs new pledges

-

First deal of its kind more than 1.5 times subscribed

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity