Top section

Top section

Bids coming in for EBRD’s first securitization

Deal will bring fourth major multilateral development bank to the market

◆ Issuer finds window between political volatility and supply onslaught ◆ Deal sets record low spread for callable sterling senior bail-in debt ◆ Investors remain on board despite tight price

Deutsche Bank becomes first G-Sib to price European Green Bond

◆ €500m 4NC3 EuGB deal priced inside fair value ◆ Greenium helps tighten spreads amid strong demand ◆ Landmark trade cements bank's ESG leadership, says treasurer

RBI and BPM push down senior funding costs to new lows

◆ Austrian lender completes its tightest unsecured debt since the start of war in Ukraine… ◆ …as BPM achieves its lowest ever senior spread ◆ High attrition function of premium and outright spread

◆ Issuer finds window between political volatility and supply onslaught ◆ Deal sets record low spread for callable sterling senior bail-in debt ◆ Investors remain on board despite tight price

Sub-sections

-

◆ Deal unaffected by Japanese macro volatility, lead said ◆ Aggressive pricing led to heavy long-end attrition ◆ Continuing trend of heavy supply for dual tranche holdco senior trades

-

◆ Belgian utility goes for 10 year paper ◆ Issuer set final size at guidance ◆ Deal skims through fair value

-

◆ First IG corporate SLB of the year ◆ Deal lands at tight end of guidance ◆ Interest in SLB format on the slide

-

Attractive pricing versus dollars luring GCC borrowers back to the single currency

-

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

-

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

-

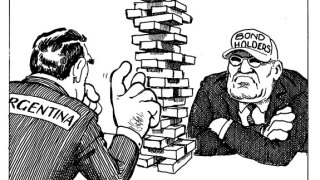

Ecuador’s market-friendly debt restructuring hit a bump in the road this week as bondholders put forward proposals that would include conditions around environmental, social and governance (ESG) factors.

-

After striking a remarkably swift restructuring deal with creditors, Ecuador’s government deserves praise. But it is unrealistic to expect such smooth discussions elsewhere, as emerging market sovereign defaults inevitably rise.

-

François-Louis Michaud was approved as the next executive director of the European Banking Authority on Wednesday. The EBA’s previous choice was rejected by parliamentarians, and this nomination faced scrutiny too over gender balance.

-

Durreen Shahnaz is founder and chief executive of Impact Investment Exchange (IIX), which says it created the world's first social stock exchange. She tells GlobalCapital about how we can rebuild a better economy, with the help of capital markets, after coronavirus.

-

CDP, the leading platform through which companies report their carbon emissions, has become the latest organisation to launch a potentially influential system of temperature ratings, so investors can work out how much global warming each company’s plans will theoretically lead to — and hence the overall temperature of a portfolio.

-

If UK pension savers knew how their money was invested, funds would be more inclined to invest exclusively in environmental, social and governance (ESG) assets. So argues Richard Curtis, the screenwriter, director and co-founder of Comic Relief. He has launched a public campaign, Make My Money Matter, to pressure UK pension funds to invest more sustainably.

-

◆ Second ever bond for the issuer ◆ Deal marketed to both SSA and credit investors ◆ Offers potential for tightening on the back of southern European convergence trade

-

BSTDB has had a tricky time since Russia attacked Ukraine, both of which are shareholders

-

Commodities trader halves its stake for £132m after shares soar

-

◆ Deal follows NextEra’s euro hybrid debut last year ◆ Eight year tranche draws the larger book ◆ More Reverse Yankee issuance expected to follow

-

The familiar problem of inter-creditor opacity has also reappeared

-

'Hard to classify' Italian corporate trade being marketed to FIG and SSA accounts

-

Craig Coben examines whether it is true that no good deed goes unpunished

-

Investors and bankers grapple with 24% fall in Bitcoin since deal was rated

-

Investment banking travel was a relentless grind, not gold card access to global glamour

-

Eight banks provided loan facility to company

-

Vaccine bond programme to issue $1.5bn this year but needs new pledges

-

First deal of its kind more than 1.5 times subscribed

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity