-

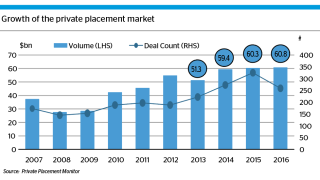

Sponsored CommerzbankPenelope Smith, Director, Head of non-German Schuldschein Origination, DCM Loans at Commerzbank, considered the role of this unique private placement instrument in international investors’ portfolios.

-

Sponsored Euromoney Country RiskEurope’s investor prospects are superficially safer due to economic recovery, but elections in Germany and in Italy, especially, present tail-risks. This is a manifestation of deeper uncertainty urging a fresh approach to risk management.

-

Sponsored Euromoney Country RiskThe rating agencies seem overzealous downgrading Chile, as commodity prices have rebounded from their lows and its financing problems are a temporary blip.

-

Sponsored Euromoney Country RiskThere are numerous risks for the government to address as the country prepares to elect a new parliament in September.

-

Sponsored European Investment BankDeveloping a Lingua Franca for Green Bonds

-

Sponsored Euromoney Country RiskThe sovereign borrower’s investment grade should be handed back, even allowing for the enforced restructuring of the food producer and retailer.

-

Sponsored Euromoney Country RiskThe economy is on the mend and it is high time the raters take notice.

-

Sponsored EuroclearHow banks, brokers and CSDs manage collateral is undergoing a once in a generation change. For market players looking at how they best prepare for this, it is important to analyse the process in which change occurs. In the world of collateral management, the revolution caused by new regulation is happening at the same time as the financial technology underpinning the sector is rapidly evolving. But that is not enough. Existing market players need to be willing adopters of the new ways of doing business, while outside innovators must also be allowed into the market. The final phase occurs when the market comes together to adopt a new set of standards that enshrines the revolution into a new way of working.

-

Sponsored CGIFThe financing of greenfield infrastructure projects in Southeast Asia has recently been boosted by the arrival of a new facility to guarantee bond investors against all risks during the construction period. The innovative solution was augmented on May 24 by the signing of a collaboration agreement between the Credit Guarantee & Investment Facility (CGIF), and Surbana Jurong Private Limited (SJ). The initiative is designed to boost the use of local currency-denominated project bonds to finance greenfield infrastructure projects in the Asean markets. GlobalCapital discussed the new facility with Kiyoshi Nishimura, CEO of CGIF.

-

Sponsored EuroclearThere has never been a greater need for banks to monitor and manage their intraday and overnight liquidity provisions.

-

Sponsored Euromoney Country RiskIt won the Euros, it won Eurovision – now it is time to win back its lost investment grades.

-

Sponsored HSBCWith policy and regulation, businesses, consumers, investors, and technology all pushing sustainable finance rapidly into the mainstream, HSBC discusses the market’s outlook and opportunities.

-

Sponsored BarclaysThe funding landscape for UK-based corporates has undergone a radical transformation since the financial crisis of 2008, driven by macro-economic changes and a growing sophistication in the way that companies finance their activities.

-

Sponsored Euromoney Country RiskExperts are beginning to feel more confident about Russia’s prospects, and its credit ratings will ultimately reflect this.

-

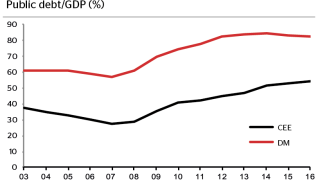

Sponsored Société GénéraleBond markets are performing well and proving safe from external political and macroeconomic factors. Borrowers are therefore likely to continue moving more of their funding into the bond markets. Societe Generale CIB suggests 10 things that issuers from Central and Eastern Europe (CEE) should bear in mind and emphasise to capital markets investors, if they want to negotiate the best financing terms.

-

Sponsored Société GénéraleOver the past 30 years, derivatives have been a force for good. Their practical application allows for more risk mitigation, yield enhancement and contingency planning, making financial markets work better.

-

Sponsored CommerzbankSince April this year, the ECB has reduced its monthly QE purchases from €80bn to €60bn. This did not have much direct effect on the covered bond market though; the ECB has predominantly scaled back the purchases of government bonds, with spreads which already sufficiently reflected this. On the covered bond side we do not expect to see any strategic changes in buying behaviour (yet) as CBPP3 (the third covered bond purchase programme) purchases are decreasing in any case for seasonal reasons amid shrinking primary market activity. However, it is ultimately only a matter of time until the ECB has no choice but to start official tapering on a broader front. Commerzbank expects the QE programme to be gradually reduced further from the beginning of 2018 and then finally cease at the end of 2018. Consequently, while up to now we have always regarded it as premature to speculate on the CBPP3 end game effects, it does make sense to start thinking now about the spread impact of the exit.

-

Sponsored by Euromoney Country RiskThe decision by Moody’s to lower its sovereign rating on China was flagged-up in ECR’s crowd-sourcing survey more than a year ago, and it will mean higher funding costs in the offshore market.

-

Sponsored Euromoney Country RiskRisk experts are still downgrading Azerbaijan in response to disappointing economic indicators, highlighting the effects of depressed oil prices and a lack of clarity from the government concerning its policymaking.

-

Sponsored Euromoney Country RiskEuromoney’s country risk survey shows political risk rising in 64 countries this year. The march of populism is a key factor investors must consider before chasing tempting returns, but there are many others to guard against.

-

Sponsored Euromoney Country RiskA stronger yen-won exchange rate underlines Japan’s perception of safety with Seoul now plunged into a crisis, awaiting elections and wary of tensions escalating on the Korean Peninsula.

-

Sponsored Euromoney Country RiskMexico is considered the most attractive emerging market (EM) by Bloomberg, but is not the safest according to Euromoney’s country risk metrics.

-

Sponsored Euromoney Country RiskThe borrower’s gradually improving risk profile could see it overtake Brazil and Turkey before too long.

-

Sponsored Euromoney Country RiskEgypt’s fall from grace is one of the more noteworthy of recent years.

-

Sponsored Euromoney Country RiskEuromoney’s survey experts continue to downgrade the borrower, disagreeing with the president’s claims there is no justification for it.

-

Sponsored Euromoney Country RiskThe OECD’s arguments in favour of a higher credit rating are endorsed by experts taking part in Euromoney’s country risk survey.

-

Sponsored Euromoney Country RiskGeert Wilders’ Eurosceptic-populist Freedom Party might win the forthcoming parliamentary elections. Yet the prospect of him forming a government is low, preventing political risk from overshadowing economic and fiscal strengths.

Sponsors

-

Sponsored by Barclays

-

Sponsored by BNY

-

Sponsored by China Southern Asset Management

-

Sponsored by CGIF

-

Sponsored by CIB

-

Sponsored by Citi

-

Sponsored by Commerzbank

-

Sponsored by CreditSights

-

Sponsored by CSC

-

Sponsored by DZ Bank

-

Sponsored by Euroclear

-

Sponsored by Euromoney Country Risk

-

Sponsored by European Investment Bank

-

Sponsored by EQ Credit Services

-

Sponsored by GlobalCollateral

-

Sponsored by HSBC

-

Sponsored by KfW

-

Sponsored by Moody's Investors Service

-

Sponsored by Ocorian

-

Sponsored by OTP Global Markets

-

Sponsored by RBC Capital Markets

-

Sponsored by Raiffeisen Bank International

-

Sponsored by Société Générale

-

Sponsored by TD Securities

-

Sponsored by UniCredit

-

Sponsored by Vistra

-

Sponsored by Wiener Börse