Free content

-

Information sharing between creditors is needed if debt restructurings are going to speed up

-

Market participants are invited to give their views on the outlook and expectations for the FIG market in 2026

-

We want your view on the corporate bond market in Europe

-

We would welcome your feedback on the outlook for the CEEMEA market

-

Voting now open to decide the market’s leading deals and institutions

-

◆ Why buy bonds when spreads are so tight ◆ Using tech to unearth new economic signals ◆ Playing the shifting relative value pitch

-

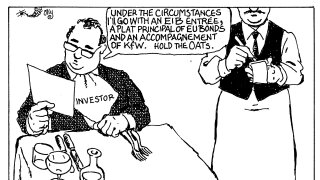

We would welcome your feedback on the outlook for the SSA market

-

This year's two powerful trends of spread compression and convergence give rare issuers a chance to shine

-

Macron's vision of a sovereign EU appeared closer in bond markets this week, thanks to French political discord

-

Banks must be careful not to throw out their babies with the bathwater as AI floods the business

-

French bond markets were blasé despite the prime minister's shock resignation

-

Sponsored by NumerixWith markets facing volatility, tighter regulation and digital change, technology providers are under pressure to deliver. Numerix — winner of Global Capital’s awards for Pricing & Valuation Provider of the Year and Risk Management Provider of the Year — has excelled through cutting-edge analytics, investment in R&D and a customer-centric approach. We spoke to the firm about how its solutions are helping clients navigate a rapidly evolving derivatives landscape.