Volatility made a comeback in European government bond markets this week.

Yields gapped higher on OAT bonds when the French prime minister, the country’s fifth in less than two years, unexpectedly walked away from the job after 27 days.

Yet fixed income traders were quick to dismiss the latest drama.

Like the European Central Bank, what concerns them most is not French politics, or even rising French borrowing costs —the saga has been running for so long that those wanting protection already have it — but signs of leakage into other bond markets.

In 2022, it was those warning signs — Spanish and French spreads had begun to follow Italian wider — that led the ECB to convene an ad hoc meeting and issue a verbal intervention and its still unused Transmission Protection Instrument.

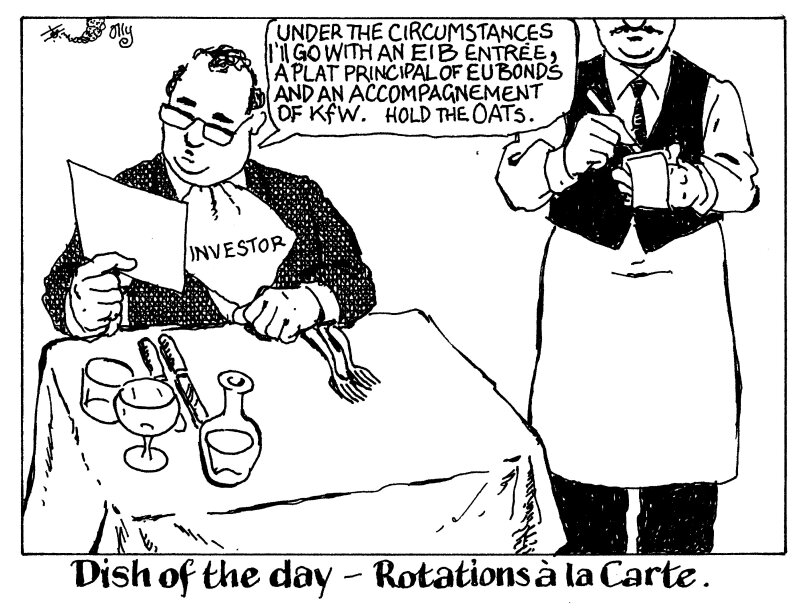

This time around, any notion of a ripple effect was firmly rejected when the European Union placed an €11bn dual bond syndication that drew €175bn of orders.

Rather than contagion, the opposite was occurring — investors were viewing EU bonds as an antidote to French sovereign risk.

When French president Emmanuel Macron delivered his famous Sorbonne speech, shortly after being elected in 2017, arguing for a sovereign Europe, he probably did not have the international bond markets in mind.

But if any sign was needed that the EU has established itself as a liquid, robust and safe haven sovereign issuer, as it would like to be seen, this was it — bond index providers, take note.

And it was not just EU bonds this week, as bankers reported that other highly rated SSA borrowers, such as the European Investment Bank, were benefitting from a rotation away from French credit risk.

KfW, the German agency and behemoth bond issuer, was another borrower benefitting from French political woes in secondary bond markets, remarked traders.

For now, the fragile balance in French politics — not so worrying as to cause broader contagion, but enough for investors to sideline French sovereign risk — is proving a boon for some European bond market competitors.