Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

When it comes to monitoring comms, surely what’s good for the banking goose is good for the governmental gander

-

Books will open on Sunday for Aramco’s first follow-on since IPO

-

◆ Which banks sell in run-up to rate cuts ◆ South Africa election and the bond market ◆ Saudi Arabia leaves peers behind

-

Books were two times covered for three Gulf banks bonds this week

-

The prices on offer mean little pushback from investors when Saudi Arabia issues more than planned

-

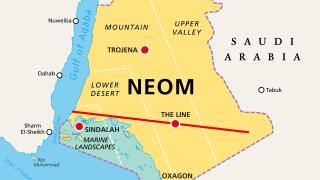

Sheer volume of issuance prevents sensible comparison to peers

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa