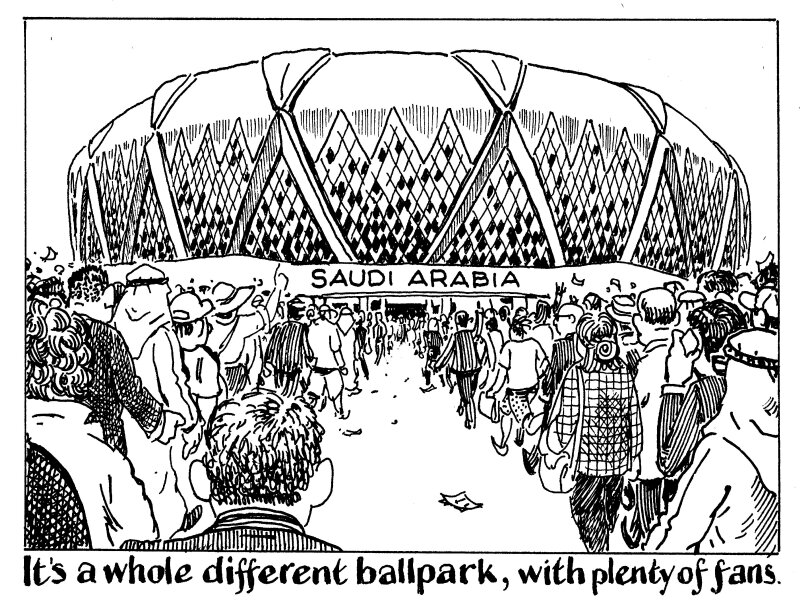

Saudi Arabia has singled itself out as a debt market issuer unlike any other — in ways good and bad — and has cast off the rest of its Gulf cohort.

Its triple tranche $5bn sukuk this week took Saudi’s funding in the bond and sukuk markets to $17bn for the year — by far the most of any emerging market sovereign so far in 2024.

The sheer volume of paper in the market makes it a different beast from other Gulf sovereigns. That $17bn stands against $5bn from Abu Dhabi this year, for example, or $2.5bn from Qatar, and these numbers do not even take into account the prolific issuance from Saudi sovereign wealth fund PIF this year versus the others.

Saudi does not seem to have tested investors’ limits, however. The $18.6bn book for this week’s deal made that clear.

Of course, Saudi paid a new issue premium — estimates from lead managers were 5bp-10bp, or 15bp-25bp from rivals using differing calculations. The comparison was made with Abu Dhabi and Qatar, which paid no premium earlier this year. But those issuers are raising a fraction of what Saudi needs to raise.

The downside is that the issuer no longer commands scarcity value and bringing deal after deal hinders secondary market performance.

However, there is a liquid market for Saudi Arabia bonds. The same cannot be said of other Gulf sovereigns.

It is also clear that investors like Saudi very much and they want to fund its ambitious plans for growth and change.

Investors have long understood that emerging market sovereign borrowers within regions can be very different from each other. That now applies in the Gulf. For better or worse, Saudi now stands apart.