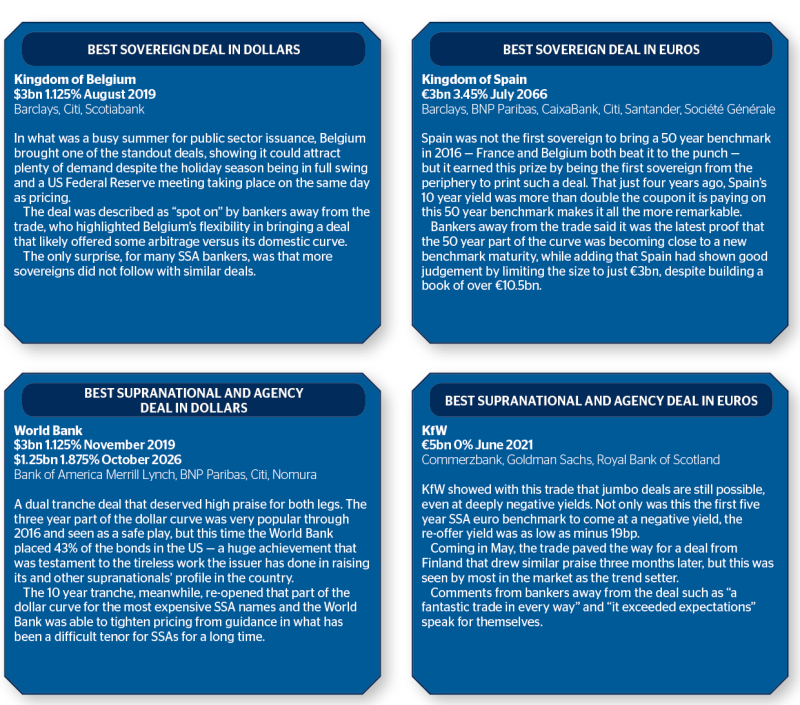

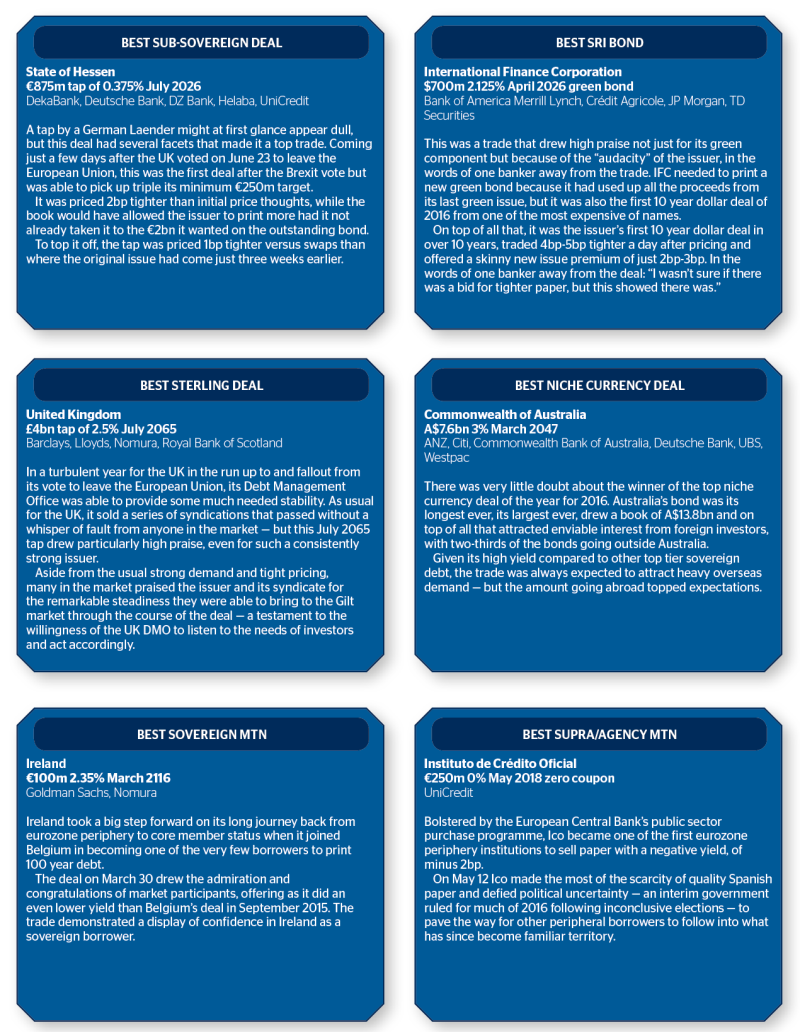

We strived to pick those trades that really made an impact — whether it was discovering new frontiers along the maturity curve, testing the depth of demand at deeply negative yields or bringing strong trades in the wake of disruptive political events.

The winners are presented here. We hope they are an apt reward for the issuers and banks involved — but also that they spark debate over whether they were truly the worthiest recipients.