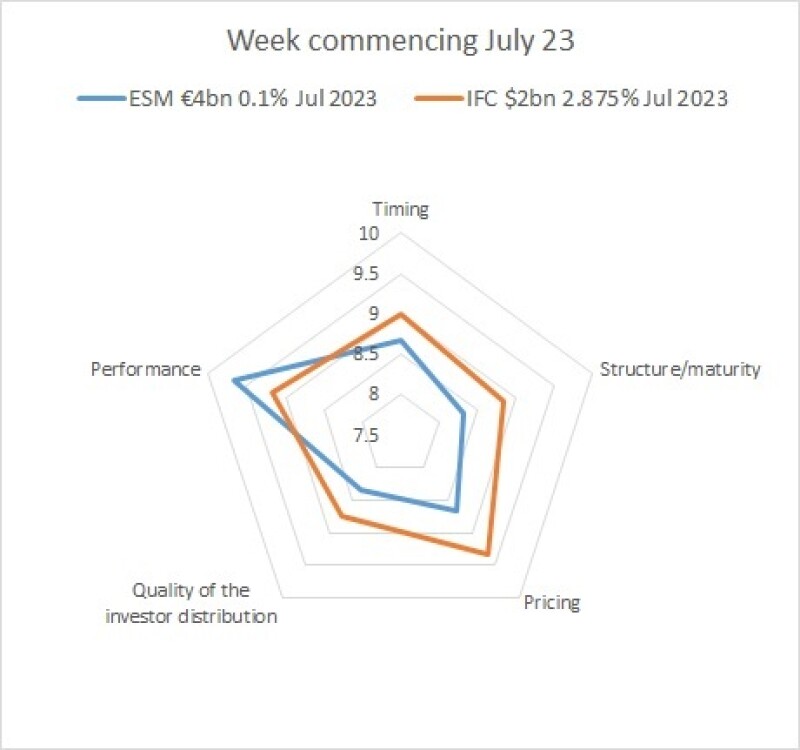

IFC’s $2bn five year global issuance on July 24 scored between 8.75 and 9.33 on the five BondMarker categories — timing, structure/maturity, pricing, quality of the investor distribution and performance — taking it to an overall average score of 9.02.

That gives it the second highest average score of the year so far, behind the UK Debt Management Office’s £6bn October 2071 Gilt on May 15, which scored 9.47. These compare with an average 7.71 for all deals scored on BondMarker this year.

On-looking bankers at the time said that IFC’s deal was a “fantastic outcome”. Leads Barclays, JP Morgan, Mizuho and TD Securities were able to price the bond at 2bp over mid-swaps, the tightest level on a five year dollar benchmark in three years.

That was reflected in the BondMarker votes, with IFC gaining 9.33 in pricing — its highest score across the five categories.

IFC’s second highest score was a 9.17 for performance, but that did not make it the best scorer in that category for the week commencing July 23.

ESM’s €4bn July 2023, priced by Morgan Stanley, Société Générale and UniCredit on the same day as IFC’s deal, scored a near perfect 9.67 in that category.

That helped boost its average score to 8.73, comfortably the highest score for an ESM or European Financial Stability Facility trade this year.

The deal won praise at the time for being a shorter dated euro play after a glut of long dated issuance, and also for its book of over €9bn. It scored 8.33 for both structure/maturity and quality of the investor distribution, although timing and pricing seemed to impress BondMarker voters more — they both scored 8.67.