Top section

Top section

NatWest plays for duration with long-dated holding company senior

◆ Two steps to terms debated ◆ Priced flat to fair value or even with negative concession ◆ Investors split on long-dated holdco supply

When loans' LTVs hit 80%, Bitcoin stakes are liquidated in seconds

Erlandsson to leave Anthropocene Fixed Income Institute, return to AP4

Founder of climate investing think tank wants to apply ideas as bond investor

When loans' LTVs hit 80%, Bitcoin stakes are liquidated in seconds

Sub-sections

-

The lender found a strong end-of-year window to issue, agreed bankers

-

Bankers expect the deal will price tighter than issuer's previous outing

-

Investment grade corporates keep piling into euros

-

Irish producer of convenience foods gets sustainability-linked revolving credit facility despite others' doubts about SLLs

-

There is high demand for CEE bank paper, said one syndicate official

-

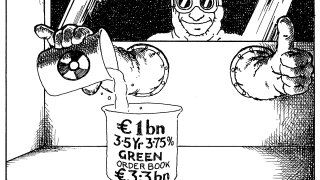

◆ Do green bonds still offer enough reward for issuers? ◆ Crédit Agricole's nuclear option ◆ Banks rush to offer better terms to sub-IG companies

-

-

Latest issue rides on coattails of big tech investment spree

-

Deal is backed by three data centers in Virginia, Illinois and Atlanta

-

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

-

Hyperscaler earnings could become a crucial date for issuance funding calendars

-

Cologix taps private ABS for latest trade

-

The yield was ultra high but Congo had little room to manoeuvre

-

Benin showed Islamic issuance is a viable market for sub-Saharan African sovereigns

-

Sovereign left little, if anything, on the table for investors

-

Observers have questioned why the country is issuing debt at this price

-

Deal will bring fourth major multilateral development bank to the market

-

The bank's regular appearances in primary markets stopped after Russia invaded Ukraine

-

Craig Coben examines whether it is true that no good deed goes unpunished

-

Investors and bankers grapple with 24% fall in Bitcoin since deal was rated

-

Investment banking travel was a relentless grind, not gold card access to global glamour

-

Eight banks provided loan facility to company

-

Vaccine bond programme to issue $1.5bn this year but needs new pledges

-

First deal of its kind more than 1.5 times subscribed

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity