Top Section/Ad

Top Section/Ad

Most recent

Second Canadian lender to declare official support for embryonic SSA issuer as government takes lead on establishing new entity

Project to establish bond-issuing multilateral bank gets under way, aiming to strengthen Nato and allies’ defence capacity and procurement

Data center ABS may have captured vast attention but the infrastructure data centers require — in particular fiber optic cable networks — will also be a rich source of securitization activity

IPO pace has been quickened but CSG structure was exceptional

More articles/Ad

More articles/Ad

More articles

-

-

New standards leave out impact but require transition plans and Scope 3

-

Guidance on thorny issues welcomed, but Commission may have created new problems

-

The one size fits all approach taken in Albany is destined to fail: it is no surprise it is facing opposition from all angles

-

Remarkable wave of euro deals is tilting the cost balance back towards dollars

-

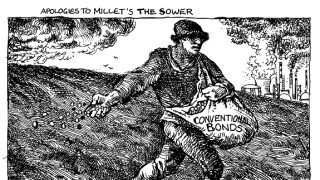

Greenwashing can be unintentional, European supervisors insist