Top Section/Ad

Top Section/Ad

Most recent

Second Canadian lender to declare official support for embryonic SSA issuer as government takes lead on establishing new entity

Project to establish bond-issuing multilateral bank gets under way, aiming to strengthen Nato and allies’ defence capacity and procurement

Data center ABS may have captured vast attention but the infrastructure data centers require — in particular fiber optic cable networks — will also be a rich source of securitization activity

IPO pace has been quickened but CSG structure was exceptional

More articles/Ad

More articles/Ad

More articles

-

Delek Drilling, the Israeli energy company, launched a $2.25bn bond sale on Tuesday, in one of the few high yield emerging market bond deals seen during the coronavirus pandemic.

-

Each week Keeping Tabs beings you the most interesting and entertaining reading from around the web that we have uncovered. This week, the perils of the EU recovery fund through the lens of the subject of Broadway's hottest show, a menacing whiteness of swans and a grim view of Hong Kong's future in finance.

-

The US Department of Labour (DoL) has proposed what it characterises as a reiteration of what has always been required of retirement fiduciaries — that they act in the best interest of their beneficiaries — urging them to disregard ESG considerations in investment decisions. In doing so, it appears not to have noticed the last decade in financial markets, which has shown that ESG investing is very much in investors’ interests.

-

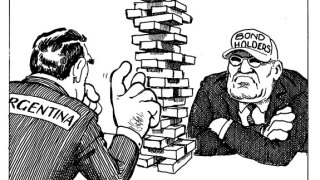

Ecuador’s market-friendly debt restructuring hit a bump in the road this week as bondholders put forward proposals that would include conditions around environmental, social and governance (ESG) factors.

-

After striking a remarkably swift restructuring deal with creditors, Ecuador’s government deserves praise. But it is unrealistic to expect such smooth discussions elsewhere, as emerging market sovereign defaults inevitably rise.

-

François-Louis Michaud was approved as the next executive director of the European Banking Authority on Wednesday. The EBA’s previous choice was rejected by parliamentarians, and this nomination faced scrutiny too over gender balance.