Top section

Top section

Major sectors in leveraged loans are trading down, making shrewd credit selection vital

Deal could include $950m of bonds

Upper mid-market firms eschew ‘exciting’ stories as cracks emerge in European private credit

More articles

More articles

More articles

-

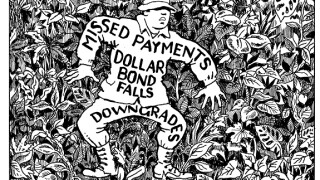

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

Philippine property developer SM Prime Holding has returned to the loan market after an absence of five years.

-

Covid-era deals looking for cheaper liability stacks are beginning to flood the market with refi and reset transactions, as they hit the end of their one year non-calls. Canyon Capital has reset and increased the size of Canyon CLO 2020-1, cutting 74bp off the margin of a senior tranche originally priced in May 2020.

-

Golden Goose, the Italian shoemaker bought by Permira just before the coronavirus pandemic struck Europe, is looking for €470m of senior secured bonds to repay bridge facilities signed in the acquisition.

-

Home Credit Vietnam is in talks with banks for a new $50m loan, with its planned fundraising receiving some early mixed response from lenders.

-

Ares Management has raised a colossal €11bn for its new European direct lending fund, but firms whose investments hit the skids through the pandemic may not find it quite so easy.

Sub-sections

shared comment list