Top section

Top section

Deal could include $950m of bonds

Upper mid-market firms eschew ‘exciting’ stories as cracks emerge in European private credit

Pharmaceuticals and energy transition also ripe sectors for M&A

More articles

More articles

More articles

-

Tyre manufacturer Gajah Tunggal had to battle weak sentiment around Indonesian credits to sell a $175m bond this week.

-

eHi Car Services tapped its 2024 notes for an additional $150m on Wednesday, bringing the total deal size to $450m.

-

Eldridge Industries has carved out part of its structured credit team to launch a new CLO investment firm, named Panagram Structured Asset Management.

-

NH Hotels has successfully refinanced its existing 3.75% 2023 bonds with a new €400m five year non-call two high yield bond, with the hotel chain supported ahead of the issue by a €100m cash injection from its shareholder, Thailand’s Minor Group. It will carry on shoring up its liquidity position in the months ahead, with a €200m sale-and-leaseback deal set to close shortly.

-

GlobalCapital reveals today the winners of its Bond Awards 2021, including celebration of the achievement of top corporate banks and issuers — and Lifetime Achievement Awards for two of Europe’s most prominent corporate funding officials.

-

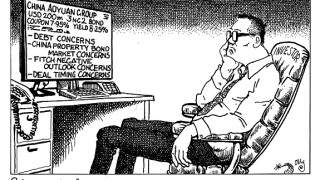

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

Sub-sections

shared comment list