Top section

Top section

◆ Refi deal came as issuer prepares IPO ◆ Deal extends the insurer's tier two curve by 10 years ◆ 'Strong bid' for Iberian FIG credit, says rival banker

◆ First two-part AT1 euro deal since Intesa's own in 2020 ◆ Funding establishes a flat curve ◆ Intesa, BNP Paribas both observe investors' reset spread threshold

◆ €500m 4NC3 EuGB deal priced inside fair value ◆ Greenium helps tighten spreads amid strong demand ◆ Landmark trade cements bank's ESG leadership, says treasurer

Data

Post-earnings issuance surged with borrowers taking advantage of tight spreads to raise more than $14bn in early February.

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

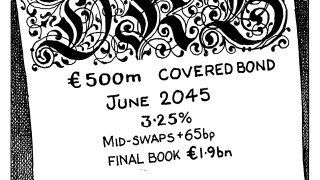

◆ Issuer's longest ever public bond ◆ Priced tighter than debut eight year Pfandbrief ◆ Still offers premium to established compatriots

-

◆ Carry turns less appealing for investors ◆ US bank holdco deals had pushed FRNs wider ◆ Opco vs holdco spread evaluated

-

Leaked papers suggest the Commission wants to give with one hand and take away with the other

-

◆ La Banque Postale sells first euro benchmark of 2025 ◆ Mediobanca and DNB return ◆ Market 'to play catch-up' after scant supply in first five months

-

◆ Highly regarded issuer prints longest covered bond for three years ◆ Deal is more expensive than SSA debt... ◆... but investors show strong demand at 'fair' price

-

◆ Views on NIP vary ◆ Price sensitivity among investors ◆ More senior deals expected

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment