Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

Domestic demand still strong amid volatility

-

Demand for sukuk has remained healthy amid the wider market volatility

-

◆ Running a bond business in a crisis ◆ Bank issuers find their way back into the bond market ◆ Can frontier emerging market sovereigns fund themselves?

-

Markets may not be shut for too long, and African sovereigns have managed debt well

-

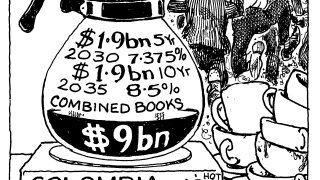

Sovereign pays at least 25bp of concession but points to healthy demand after broader spread widening

-

The dollar market is going to be an unreliable friend for some time

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa