Top section

Top section

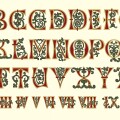

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

This week's flurry of deals takes year to date volume beyond £8bn

The AI race is pushing hyperscalers to hunt for cash to fund rising capex needs, and they are coming to Switzerland

Data

More articles

More articles

More articles

-

◆ A3 rated name opens wider than BBB euro debutant Galderma ◆ Rewarded with big, sticky book ◆ Attrition still clear in other trades

-

◆ Borrowers pile into the market…◆ …but almost all only for small benchmark sizes ◆ Concessions still small as high demand battles low supply

-

WFE study finds average gap of 2.5 years between carbon removal and credit issuance

-

◆ Deal starved sterling investors pile into Wessex Water ◆ Final demand of £2.45bn ◆ First sterling deal this year from UK wastewater

-

◆ Borrowers keep an eye on headline risk ◆ But trades land inside fair value ◆ Manchester Airport has blow-out debut

-

◆ Sterling still open for business ◆ Slight preference for longer tranche ◆ Wessex Water next up

Sub-sections