Top section

Top section

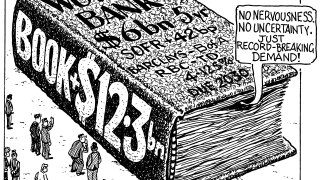

‘Amazing’ reception for long dated syndications but issuers explore different options amid persistant duration risk

Law firm also chosen to advise government on inaugural issue

German bond house adds to growing roster of primary dealerships

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

◆ First new benchmark from the issuer in two months ◆ Record IOIs but pragmatism remains ◆ Investors welcome MDBs back in primary after recent Trump noise

-

◆ Nineteen times covered books for €3bn of taps ◆ Shorter, older bonds replaced by long ones ◆ ‘Clever trade’ and ‘very precise pricing’ as a result

-

◆ Priced off recent peer issue ◆ New levels found after swap spread moves ◆ Deal twice subscribed

-

Canada's strong dollar deal suggests investors are looking beyond Trump threats

-

Issuer expects second deal of same maturity in the autumn, while funding needs may change

-

The sovereign has raised more than £59bn from syndications in this financial year

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment