If you read the front pages — GlobalCapital included — you might think the world order is crumbling.

Since US president Donald Trump was inaugurated on January 20, tariffs, threats to European security and even a revival of the idea of manifest destiny have poured out of the White House.

In response, Treasury yields have whipsawed, US equity gains have been wiped out and fears of a ‘Trumpcession’ are spreading like wildfire.

But Canada’s latest US dollar bond outing suggests investors might be willing to look beyond the headlines.

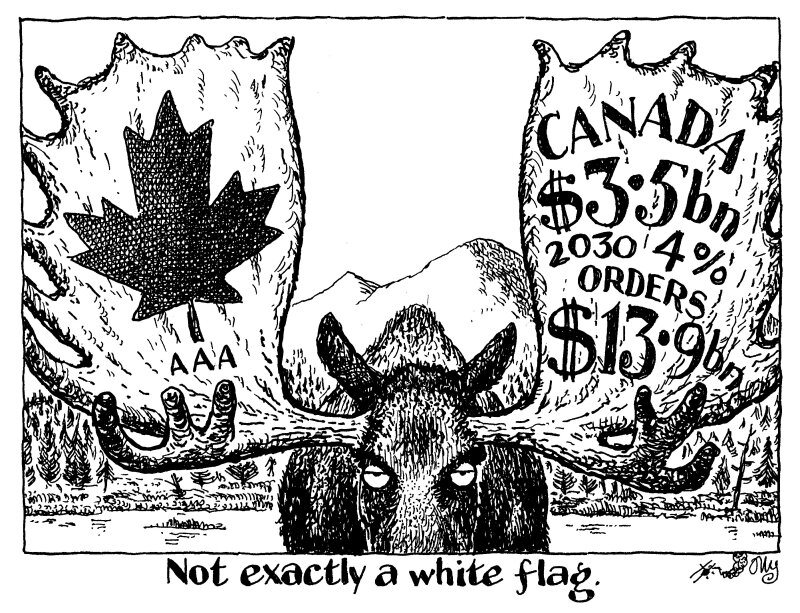

The only north American sovereign to be triple-A rated by S&P landed a $3.5bn 4% March 2030 deal at a spread of 11bp over US Treasuries on Tuesday.

Investors overlooked a 50% US tariff on Canadian steel and aluminium announced on the day of bookbuilding, with demand for the deal closing at $13.9bn — a record in for the Canadian sovereign in the currency, allowing it to increase the deal by $500m.

To Canadians, these tariffs are an attempt at “annexing our country through economic coercion,” as Mélanie Joly, Canada's foreign affairs minister, put it this week.

But ultimately, investors would have likely not bought Canada’s deal if there was even a small chance of the country becoming the 51st state anytime soon — or 52nd if Trump gets his hands on Greenland first — tariffs or not.

Canada’s bond is set to mature in March 2030, some 14 months after Trump must leave the Oval Office. Although the next 1,400 days or so may feel long, to long term fixed income investors, Trump II will not be able to match the duration of Canada’s sovereign debt.