Free content

-

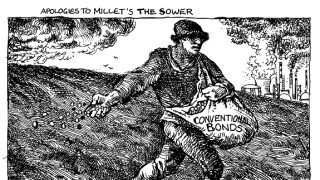

The chancellor presented an ambitious plan to boost domestic investment in UK startups, but its targets should tread carefully

-

Sponsored by MarketAxessThe multifaceted nature of emerging markets means that successful trading platforms need to deliver cutting-edge technology and a deep understanding of different clients’ needs and workflows. MarketAxess excels on both fronts. Combining world-class data and analytics, unique execution protocols, and a consultative, client-focused development strategy, the firm was a clear winner of Best Secondary Market Trading Platform.

-

The reason for a no call is an important detail. The rules of the game don't always apply when conditions are tough

-

◆ The World Bank's Valerie Hickey 'we need green systems, not projects' ◆ Two airports praised for SLBs ◆ Three IPOs revive market for European listings

-

Already comfortable with the credit? Then why not pick up exposure with some extra juice?

-

Labour: don’t change the covered regime, look to secured notes instead

-

Vote for the best in covered bonds by Friday July 28

-

Less EU issuance and earlier front-loading from others could leave investors fighting for primary bonds come autumn

-

◆ Its pipes leak but does Thames Water’s debt structure hold water? ◆ How the EU’s funding for H2 impacts the SSA market ◆ LatAm issuers like London buses but not for the obvious reason

-

Paying up is hard to do, but it is sometimes worth the pain to ensure funding certainty

-

-

The sovereign issuer’s track record of resilience in the face of market shocks suggest the country’s most recent round of problems is unlikely to be too impactful