Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

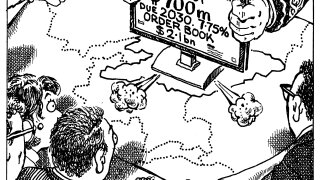

Pricing was tight after sovereign found healthy demand

-

EM investors may be happy to see some senior supply after glut of tightly priced AT1

-

◆ ABN eyed traffic jam ◆ NIBC competes with popular names ◆ Pekao manages book sensitivity

-

Strong local bids enable AT1 sukuk issuers to set yields far below where overseas buyers see fair value

-

Cash-heavy Islamic buyers allow sukuk issuers to grow 'more and more aggressive', said a banker

-

More Reits to come after Dubai Residential won demand from sovereign wealth funds, family offices

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa