Top section

Top section

The country will use all the money raised for liability management

The country is one of the highest regarded sovereign issuers on the continent

The government has been much more proactive in its debt management since a scare in 2024

Data

More articles

More articles

More articles

-

Turkey has a good green profile versus peers, said one investor, but governance is the big worry

-

OQ's oil drilling unit was Oman's biggest listing since 2010

-

Sovereign is prioritising tapping new investors, not securing low prices, with its ESG framework

-

The collapse of two US banks has muddied the picture of the direction of dollar interest rates

-

A rally in US Treasuries could be a win for emerging market bonds

-

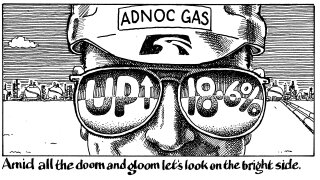

Biggest ever Abu Dhabi IPO defies jitters after SVB collapse

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa