Top section

Top section

Ivory Coast squeezed tight, taking $1.3bn

The country will use all the money raised for liability management

The country is one of the highest regarded sovereign issuers on the continent

Data

More articles

More articles

More articles

-

◆ New legislation will drive supply ◆ Covered bonds become a crucial part of Polish funding mix ◆ Up to €1bn of fresh paper expected this year

-

Saudi tipped to be a hot spot for loans in the fourth quarter

-

The government has been stung by uncapped payments to warrant holders

-

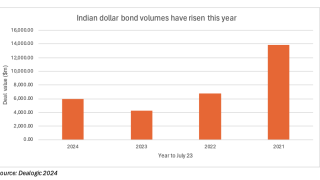

Innovation, strong execution and supply dearth benefit Indian issuers

-

Chilean state-owned oil name offers no concession as Murano, ATP line up for Thursday

-

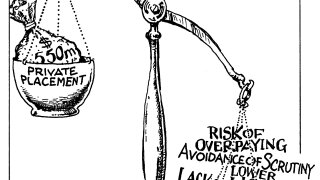

Investors dislike the lower transparency and liquidity inherent in private placements

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa