Top section

Top section

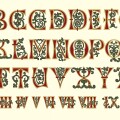

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

This week's flurry of deals takes year to date volume beyond £8bn

The AI race is pushing hyperscalers to hunt for cash to fund rising capex needs, and they are coming to Switzerland

Data

More articles

More articles

More articles

-

◆ Philip Morris flattens short end curve by 7bp ◆ EssilorLuxottica lands with single digit concession ◆ Wesfarmers increases deal size

-

Embattled water utility was recently found accountable for breaches in wastewater operations and dividend payments

-

◆ Both borrowers comfortably oversubscribed ◆ Deals tightened above the 37bp average ◆ Little fatigue seen after a bumper May

-

June could be very busy as borrowers come early to exploit good conditions

-

Factors stack up to make US issuers and investors eager

-

Despite the latest legal development being ostensibly market pleasing, many feel little reason for cheer

Sub-sections