JP Morgan has unveiled new versions of its famous EMBI suite of emerging market bond indices with altered weightings, to reflect issuers’ ESG qualities. And S&P is planning to launch this year an ESG Evaluation — like a rating, but addressing ESG performance instead of credit risk.

Both moves are welcome. The more investors pay attention to ESG, the more issuers will have to improve their behaviour. Investors love benchmarks, and it seems likely the new EMBI range will seed new strategies and funds that favour EM issuers with better morals.

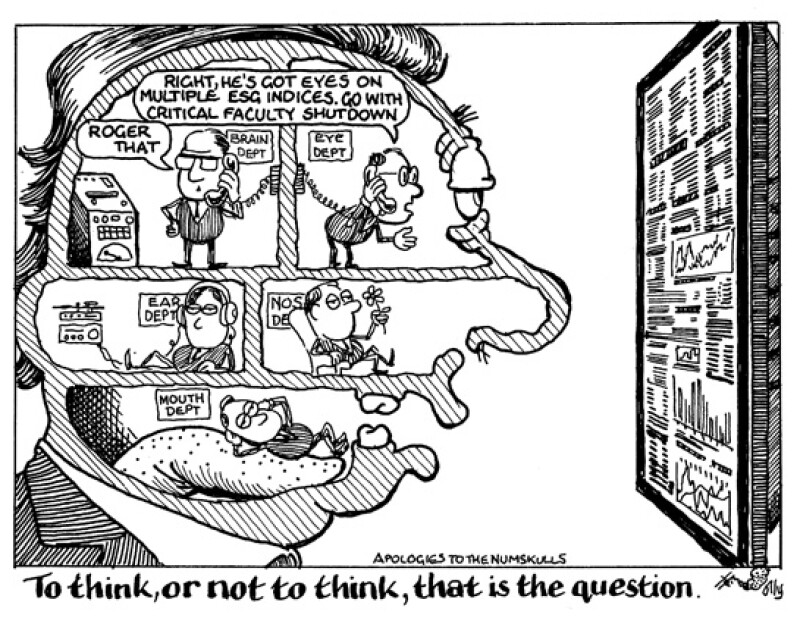

But initiatives like this have to come with a caveat. ESG issues are so complex and hard to quantify that there is a tendency to long for someone else to do the thinking.

Even JP Morgan is feeding its index weighting calculator with ESG scores decided by two external providers, Sustainalytics and RepRisk, as well as the Climate Bonds Initiative’s view of what a green bond is.

If investors do no more than switch to tracking ESG-enhanced versions of normal indices and ratings, something will have been achieved.

But there will be a risk of stale groupthink — people being satisfied with mild improvement.

Global warming is coming. To achieve change at the necessary speed, it will not be enough to exclude thermal coal, as JPM does. The whole economy must decarbonise.

Anyone wondering what the downside can be of outsourcing critical thinking about risk need only read The Big Short (or back issues of EuroWeek from 2007-8) for the work investors and dealers delegated wholesale to ratings agencies in the subprime crisis.

Farsighted investors, especially if they want to outperform, should look at indices and ratings, but add their own thinking. The alpha — and innovation in financing sustainable development — will lie in improving on the benchmarks.