Top section

Top section

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

◆ Deal thought to be KfW's dollar benchmark finale for year ◆ Tight Treasury pricing beats World Bank's 6.9bp record spread ◆ Issuer has no need for a big benchmark

-

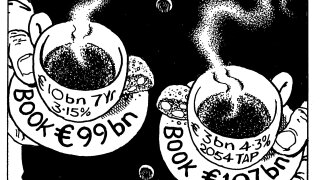

◆ Dual-tranche deal attracts €200bn of orders ◆ New seven year was somewhat unexpected ◆ Bookbuilding started with 4bp of premium

-

Increased Gilt issuance is not the only thing that will scare the bond market as Starmer and co. face up to reality that there is no such thing as a free lunch

-

The rise of compliance culture and tech have created an atmosphere of mistrust

-

◆ Bond priced with no new issue concession ◆ Spread to swaps drives orders ◆ More price discovery for French agencies

-

◆ French issuer ends year-long absence ◆ Pricing was inside fair value ◆ Triple-digit spread over swaps

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment