Top section

Top section

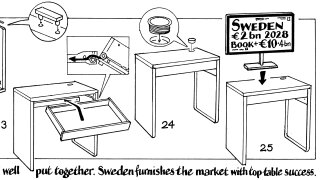

New product 'ticks boxes' including more investor diversification for Paris-based supranational, which also sold its largest Kangaroo

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Only one of Canada's big five banks has yet to publicly support new defence bank initiative

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

Islamic Development Bank deal sold inside the curve

-

◆ Speculative interest anticipated ◆ Geopolitical tensions make little dent ◆ 15 year sweet spot for Dutch pension funds

-

White House mis-steps have raised hopes the euro can supplant the dollar

-

◆ Scarcity value draws buyers ◆ Nordic investors lured by big pickup against krona ◆ Bankers debate euro or dollar for next international bond

-

Some thought the new issue premium was slim, but others saw it in double digits

-

Promoters expect new MDB to get go-ahead this year

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment