Top section

Top section

Recent Italy syndication prompts talk of change in how sovereigns manage syndicates

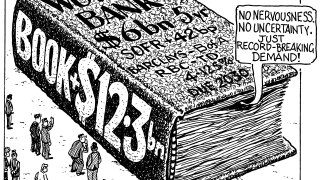

Reopening the €1.75bn bond issued in January attracts huge investor interest

Law firm also chosen to advise government on inaugural issue

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

The sovereign raised €11.3bn with BTP Valore but retail appetite has declined

-

US bank hires five rates traders in all

-

Product remains good tool for issuers but one group of investors is dominant

-

Redemptions, limited supply and a favourable rates outlook created a window for the issuer

-

Another German agency achieved a greenium to follow on from KfW deal

-

Global leadership reshuffling as sovereigns and supranationals chief retires on May 31

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment