-

Sponsored KfWKfW has one of the largest and most successful green bond issuance programmes in the market and now, with a new mandate from the Federal Government to help deliver ambitious climate goals, it is pushing ahead with a strategy that enshrines sustainable transformation as the Group’s primary strategic goal.

-

Sponsored OcorianActive management, structural protections and refinancing have aided the resilience of collateralised loan obligations amid a challenging period for structured finance. The increasing embrace of environmental, social and governance factors in CLOs could aid the market’s recovery and future growth, says Ocorian’s Nick Bland, head of UK client services, and Kareem Robinson, client director.

-

Sponsored CSCThe US consumer ABS market is in the middle of a balancing act, as investors cautiously look at indicators of further economic pain while also eyeing riskier assets in the hunt for yield, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

Sponsored CSCAs yields have collapsed elsewhere under pressure from central bank interventions, fixed income investors have increasingly sought higher returns in the esoteric ABS sector, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

Sponsored CSCWhile it’s difficult to be positive on the outlook, securitization market participants expect only a modest increase in nonperforming loans in Europe this year, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

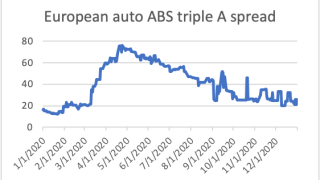

Sponsored by CSCMarket participants expect European consumer ABS spreads to remain flat or tighten in 2021, despite the potential for these deals to reflect economic stresses and rising unemployment, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

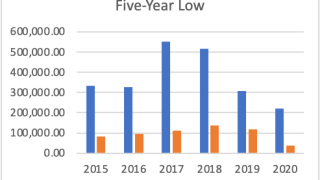

Sponsored CSC2020 was an extraordinary year. It was period many would rather forget in their personal lives, but a year of outsize returns in pockets of securitized products. It was also a year that turned the outlook for securitization on its head.

-

Sponsored HSBCGlobalCapital and HSBC hosted a virtual roundtable in mid-January to discuss the blowout start to high yield bond issuance in 2021. Leading market experts highlighted how Asia’s debt markets have shifted — and how borrowers are positioning themselves for the rest of the year.

-

Sponsored UniCreditThroughout these uncertain times, UniCredit is providing a point of reference for the CEE, thanks to our strong commitment to supporting clients and the region.

-

Sponsored UniCreditUniCredit’s Central & Eastern Europe (CEE) division was aware of the threat of Covid-19 early on, and took decisive measures to mitigate its impact.

-

Sponsored CitiJason Channell, Head of Sustainable Finance, Citi Global Insights examines the broad understanding of environmental, social and governance factors, how these have become a mainstream economic concern, and how sustainability policy is impacting supply chain finance.

-

Sponsored Raiffeisen Bank InternationalRBI follows a “profit-with-purpose” business model with explicit alignment of its activities with social, environmental and economic responsibility. We help develop sustainable economies and support our customers’ transition to zero carbon activities.

-

Sponsored Société GénéraleAt this year’s Central & Eastern European Forum, Société Générale hosted the workshop titled ‘CEE central banks’ balance sheet expansion: a necessity or a risk?’. The speakers were Radoslaw Cholewinski (deputy head of fixed income at Pekao TFI), Martin Dolejs (portfolio manager, pension fund and insurance portfolios at Allianz), and Zoltan Aroksallasi (FX and rate strategist at Erste Bank), and I thank them for their insight, their knowledge, and their time. By Marek Drimal, EMEA Strategist, moderator of the workshop.

-

Sponsored CabeiThe damage caused by hurricanes Eta and Iota, which slammed into the Central American states at the end of November, caused widespread damage and further misery to millions in countries that were already suffering from the Covid-19 pandemic.

-

Sponsored Raiffeisen Bank InternationalRaiffeisen Bank International’s clients are increasingly looking to achieve more sustainable, fairer and more transparent ways of doing business. In this context, RBI maintains a comprehensive dialogue with an ever-increasing pool of clients on sustainable finance, e.g. bonds, loans and Schuldscheine. We focus our attention not only on “green”, but also cover sustainability-linked instruments, a rapidly growing area in the sustainable finance universe.

-

Sponsored CitiThe current global health crisis has surfaced an important discussion around the connection between sustainability and the broader issues weighing on our society. So, if we take one lesson away from these intersecting crises, it is that our physical and economic health, our sustainability and resiliency, and social justice are inextricably linked.

-

Sponsored UniCreditBy Jana Hecker, Global Head of Equity Capital Markets, UniCredit

-

Sponsored Société GénéraleDuring last January’s conference in Vienna, we felt that sentiment around CEE was mostly optimistic, but — to be frank — slightly unenthusiastic. It seemed as though everybody was expecting another solid, but ordinary year ahead. The news about the novel coronavirus in China was very distant.

-

Sponsored Raiffeisen Bank InternationalSince 2018, Raiffeisen Bank International has issued several green bonds. Targeting private and institutional investors, the bonds support the growth of green financing at RBI’s headquarters and across its subsidiary banks in CEE, thereby facilitating a reduction of more than 60,000 metric tons of CO2 emissions per year. This corresponds to the annual greenhouse gas emissions of more than 13,000 cars or almost 7,000 households.

-

Sponsored Raiffeisen Bank InternationalEuropean green bond issuance has significantly outpaced that in other regions over the last four years and in 2020 the European Union is set to be responsible for more than 50% of global green bond issues (sources: S&P Ratings, Climate Bond Initiative).

-

Sponsored European Investment BankFilm buffs recognise that sometimes a sequel can be better than the original. Perhaps it does not have the same novelty, but scriptwriters can move on from establishing the back story to delivering a movie with wider appeal.

-

Sponsored CreditSightsCovid-19 has not put the brakes on deal-making in the European telecommunications, media and technology (TMT) sector and we expect M&A activity to continue. As such, we view the nuances of change of control (CoC) language in deal documents as important. By CreditSights.

-

Sponsored by European Investment BankThe European Union’s new green grammar book is multiplying the impact of climate finance. From funding to lending to innovation, the EU Taxonomy is helping embed climate throughout the European Investment Bank’s activities.

-

Sponsored CIBAmid exceptionally challenging global conditions, Egypt’s largest private sector bank revealed resilient performance in 2020, delivering top-line growth.

-

Sponsored European Investment BankThe European Investment Bank isn’t letting the Covid-19 pandemic divert it from its common purpose, but is focusing it more clearly than ever on the development sphere.

-

Sponsored European Investment BankThe European Investment Bank took a bold step when it announced in November last year that it would end funding for fossil fuel projects, alongside a slew of ambitious targets. This year has been about putting in place the roadmap for its transformation

-

Sponsored OcorianThe last six months have been unprecedented times for the global capital markets, and securitization has not been spared the volatility. In both the US and Europe, structured finance sectors have had to navigate worsening economic conditions, widening spreads and a deeply uncertain outlook for the rest of 2020 and beyond. With the help of central bank and government support measures, the worst of the crisis may have been avoided, but securitization may also have a role to play in the coming recovery. GlobalCapital spoke with Ocorian’s Sonal Patel and Sinead McIntosh on the outlook for capital markets, the state of securitization and the prospects for 2021.

Sponsors

-

Sponsored by Barclays

-

Sponsored by BNY

-

Sponsored by China Southern Asset Management

-

Sponsored by CGIF

-

Sponsored by CIB

-

Sponsored by Citi

-

Sponsored by Commerzbank

-

Sponsored by CreditSights

-

Sponsored by CSC

-

Sponsored by DZ Bank

-

Sponsored by Euroclear

-

Sponsored by Euromoney Country Risk

-

Sponsored by European Investment Bank

-

Sponsored by EQ Credit Services

-

Sponsored by GlobalCollateral

-

Sponsored by HSBC

-

Sponsored by KfW

-

Sponsored by Moody's Investors Service

-

Sponsored by Ocorian

-

Sponsored by OTP Global Markets

-

Sponsored by RBC Capital Markets

-

Sponsored by Raiffeisen Bank International

-

Sponsored by Société Générale

-

Sponsored by TD Securities

-

Sponsored by UniCredit

-

Sponsored by Vistra

-

Sponsored by Wiener Börse