Free content

-

Agrobank has clearly paid attention to investor feedback since the summer but in stalling its new issue it risks losing its audience

-

◆ PRA consultation paper provides further UK reg hints ◆ Life in European CLOs ◆ Babies in the office

-

◆ The Beatles may have a new, if that is the right word, song but one of their classics sums up Zambia's debt restructuring best ◆ The bank treasurer's dilemma ◆ A new index for the covered bond market

-

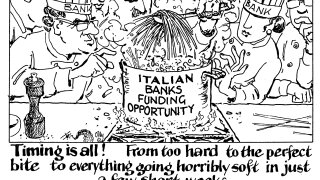

Italian banks should seize a lift in sentiment to distance themselves from the sovereign

-

The bank has accelerated its expansion at the expense of bigger rivals and wants to be among the top five banks in corporate finance in Europe

-

Investment grade companies have defied logic by leaving it until now to refinance

-

Sold as an attempt to increase oversight of the digital market, the UK's crypto regulation will actually serve the interests of an inherently risky industry

-

Sponsored by CitiA world-class team, decades of dedication to the market and unparalleled coverage across different products all helped put Citi ahead of its competitors in 2022. The firm has taken home well-deserved awards for credit derivatives in the Americas, Europe, and Asia, as well as interest rate derivatives in the Americas.

-

A company missing its numbers so soon after its IPO is not normal

-

Another Fine Mezz was all over the ABS East 2023 conference like an expensive but well used tux, with interviews from Affirm, KBRA and Loomis Sayles

-

'When a key investor steps away, you can still syndicate the deal', Blackstone Credit's Alex Leonard tells GlobalCapital

-

Infrastructure combines new, existing and traditional elements