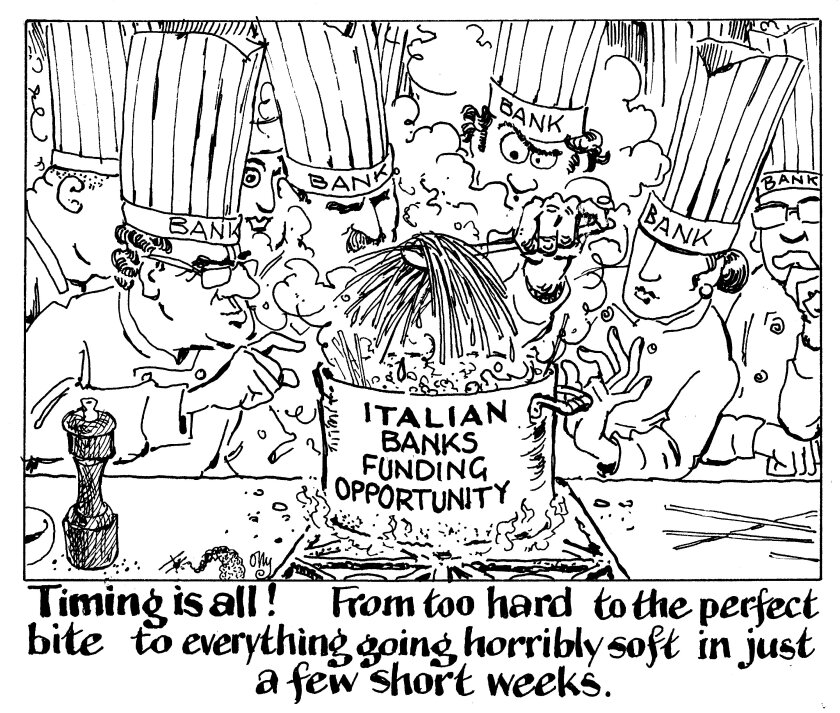

Italian banks are enjoying an auspicious moment that they can use to their advantage, to distance themselves from a still far off — but potentially disastrous — doom loop with their government.

A swift boost in sentiment has followed last week’s European Central Bank monetary policy meeting, which convinced market participants that we had reached peak rates.

The ECB also kept silent on several unconventional monetary tightening measures it had been considering, such as raising the minimum reserve requirement for banks and bringing forward the end of reinvestment under its Pandemic Emergency Purchase Programme. Italy’s central bank governor, Ignazio Visco, had warned against both of these, fearing they would damage the economy.

Since the meeting, BTP yields have fallen and Italian banks’ credit spreads have tightened. This gives the banks a golden opportunity to go out and tell their credit story to investors.

Italian banks, like those in other countries, are constrained by the sovereign’s rating ceiling. This is frustrating for bank treasurers, as they have improved their financial strength and reduced their non-performing loans over the years.

But concerns over Italy’s deteriorating debt-to-GDP ratio remain high, and the recent bout of interest rate volatility rang eerie echoes of the 2012 European sovereign debt crisis.

Unfortunately for Italy, unlike a decade ago, the ECB is bent on quantitative tightening, rather than easing, so it is not on the face of it likely to support BTPs.

Can a tightening of the BTP-Bund spread, now below 200bp, be sustained? It is questionable, as governments and banks will have to compete for investors' attention next year in the absence of QE.

Yet this week’s market perception that peak rates are here has bought Italian banks some time.

Now may be a perfect moment for them to engage with investors, after their third quarter results but before the ECB’s December meeting. The Bank is expected then to bring forward the ending of Pepp reinvestments.

The Italian banks should move fast.

A test looms for Italy on November 17, when Moody’s releases an update on its Baa3 rating.

If the rating stays steady, it could propel Italian banks, even lower tier issuers, to the covered bond market.

But this would be a short window, as the next — far more crucial — test is the government’s budget approval process in December.

An adverse market reaction to the budget could turn into a significant risk next year.

Even if banks choose not to fund imminently, targeted investor work now could help them stay out of the spiral if the sovereign's troubles worsen, and alleviate their funding difficulties when they need to print.