Free content

-

Foreigners' love of Swiss francs presents an unlikely opening for overseas borrowers

-

The necessity of clauses that help developing countries recover from catastrophes is getting more acute

-

◆ What is pushing CLO mezz wider ◆ FIG pre-funding underway ◆ What happened at the World Bank/IMF Annual Meetings

-

Data-deprived markets should give the shutdown the attention it deserves

-

Owners of the bonds face a long route to a payout but have a precedent in sight

-

GlobalCapital is pleased to announce the launch of its 2026 European Securitization Awards

-

World Bank online dashboard helps countries evaluate targets

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

New dad faces tough reality of time management

-

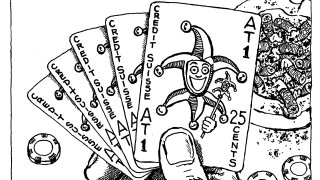

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

GlobalCapital's inaugural MTN Awards 2026 are underway — the market’s only awards dedicated to the market. But time is running out to make your case

-

International Court of Justice ruling clarifies World Bank Group's obligations