Top section

Top section

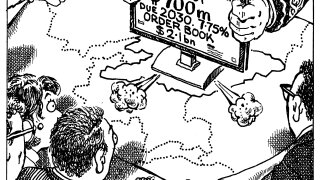

The sovereign is ramping up overseas issuance, plans to branch out into new currencies

Premium to dollars was in the high single digits, said a lead

The UAE bank capped the deal size at $500m, gaining some leverage over pricing

Data

More articles

More articles

More articles

-

◆ EU’s securitization plan leaked ◆ The first new EM sovereign issuer for years ◆ Who can be sued for climate change?

-

Pricing was tight after sovereign found healthy demand

-

EM investors may be happy to see some senior supply after glut of tightly priced AT1

-

◆ ABN eyed traffic jam ◆ NIBC competes with popular names ◆ Pekao manages book sensitivity

-

Strong local bids enable AT1 sukuk issuers to set yields far below where overseas buyers see fair value

-

Cash-heavy Islamic buyers allow sukuk issuers to grow 'more and more aggressive', said a banker

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa