Top section

Top section

The sovereign is ramping up overseas issuance, plans to branch out into new currencies

Premium to dollars was in the high single digits, said a lead

The UAE bank capped the deal size at $500m, gaining some leverage over pricing

Data

More articles

More articles

More articles

-

-

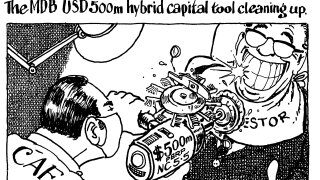

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

Nearly all subordinated issuance this year from the region has been in the AT1 sukuk format

-

BEH offers rare chance to buy non-sovereign Bulgarian debt

-

Klein appointed head of EMEA capital markets

-

International bond issuance will still be lower than many of the past few years

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa