Top section

Top section

The sovereign is ramping up overseas issuance, plans to branch out into new currencies

Premium to dollars was in the high single digits, said a lead

The UAE bank capped the deal size at $500m, gaining some leverage over pricing

Data

More articles

More articles

More articles

-

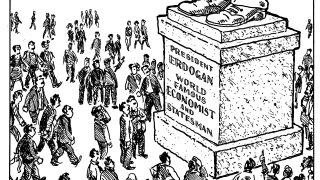

An uprising in Turkey inspired by the protests this week in Kazakhstan would not be a huge surprise

-

ESG angle helps BCI stand out after slew of Chilean Swiss issuance in 2021

-

Slovenia four and 40 year pair begins CEE new issuance for the year

-

Green, social and sustainability-linked bonds in the pipeline

-

Sovereign wraps up more than half of external funding needs for the year and refinances old bonds

-

Currency crisis will not deter country's bond plans

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa