Top section

Top section

The country will use all the money raised for liability management

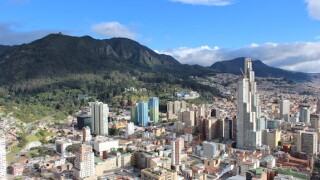

The country is one of the highest regarded sovereign issuers on the continent

The government has been much more proactive in its debt management since a scare in 2024

Data

More articles

More articles

More articles

-

Transnet to print first dollar bond for over a decade

-

Bookrunners were unsure how much demand there would be given the drought in Turkish bank issuance

-

The deal from the largest Polish bank is expected to serve as a reference for its future senior non-preferred funding while also guiding other CEE bank issuers

-

Turkish state owned banks are not under government pressure to issue in dollars, said bankers

-

EM bond buyers scramble to put cash to work allows sovereign to print far inside level of last deal from two months ago

-

Buying back debt cheaply does nothing for long-term debt sustainability nor bond market access

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa