Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

The country rarely issues more than one public bond a year

-

Previous changes of the central bank's governor were unwelcome, but the market was steady on Monday

-

◆ The first of a new asset class in SSA debt ◆ Full inspection of AfDB's landmark deal ◆ A power shift in the European CLO market

-

Investors want to keep buying new bonds even after record January, but uncertainty over flows could cool demand

-

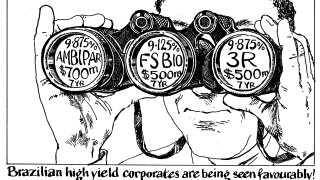

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

Banque Ouest-Africaine de Développement's deal in December will be followed by more this year

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa