Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

CFO and former trader is seen as natural successor after Noel Quinn unexpectedly stepped down

-

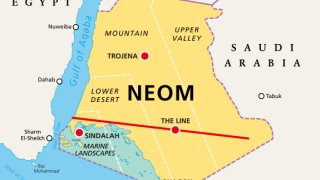

Only Saudi banks provide facility, as Western banks say the lack of ancillary opportunities makes the business case difficult

-

Access to debt markets is increasingly relevant to CPI's ratings, said Moody's

-

Orders for the debutant's deal were building 'nicely'

-

Dubai supermarket group's IPO is multiple times covered, say sources

-

Ex-banker joins trading platform as demand for digitisation grows

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa