Top section

Top section

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

Jordanian bank wants to move into investment banking

Very few, if any, Gulf issuers are looking at sterling bonds

Data

More articles

More articles

More articles

-

When and how Ukraine will regain this market access is highly uncertain

-

Higher economic growth does not automatically mean sovereigns can pay more on their debt

-

◆ New legislation will drive supply ◆ Covered bonds become a crucial part of Polish funding mix ◆ Up to €1bn of fresh paper expected this year

-

Saudi tipped to be a hot spot for loans in the fourth quarter

-

The government has been stung by uncapped payments to warrant holders

-

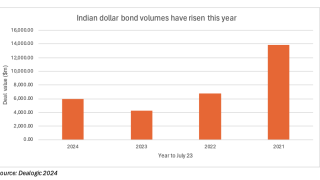

Innovation, strong execution and supply dearth benefit Indian issuers

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa