Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

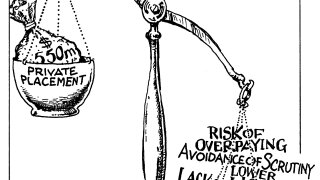

Bond specialists sceptical that auctions can yield better results than bookbuilding

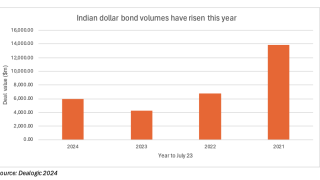

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

Saudi tipped to be a hot spot for loans in the fourth quarter

-

The government has been stung by uncapped payments to warrant holders

-

Innovation, strong execution and supply dearth benefit Indian issuers

-

Chilean state-owned oil name offers no concession as Murano, ATP line up for Thursday

-

Investors dislike the lower transparency and liquidity inherent in private placements

-

Deal brought to market with zero NIP after 'continual demand'

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa