Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

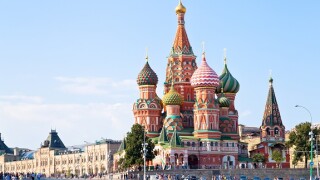

Development bank's credit ratings suffered a blow after Russia's invasion of Ukraine

Books were nearly three times the issue size

◆ Higher rated Austrian lender offers more spread for similar senior preferred bond ◆ Big demand pushes deal inside fair value ◆ BCP still prints its tightest unsecured debt for more than five years

After a record 2024, Turkish corporate issuance slowed last year

More articles/Ad

More articles/Ad

More articles

-

Russia's second largest gold producer Polymetal has raised a green loan.

-

The eventual result of Tuesday's US presidential election could have a monumental impact on the position of key emerging markets states like Russia and Turkey in the international arena.

-

Ozon, the Russian e-commerce company, has filed its initial paperwork for a US listing that could be squeezed in before the end of the year.

-

Donald Trump and Joe Biden each present a different set of medium-term risk factors for emerging markets if they win next week’s US presidential elections. But the US Federal Reserve’s promise to keep rates lower for longer — combined with unprecedented monetary policy support from other developed market central banks — should provide a cushion that is more relevant to EM bonds than the Oval Office’s occupant. Mariam Meskin and Oliver West report.

-

Samolet, the Russian real estate company, completed a Rb2.9bn ($36.6m) IPO in Moscow on Thursday, the first part of a two-stage process which the company hopes will culminate in a larger listing next year.

-

The announcement this week of two acquisitions involving European and emerging market companies has cheered loans bankers who have been missing big M&A tickets because of the Covid-19 pandemic.