Top section

Top section

The country will use all the money raised for liability management

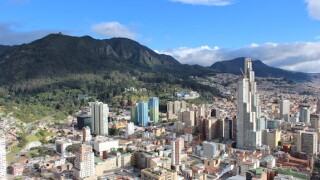

The country is one of the highest regarded sovereign issuers on the continent

The government has been much more proactive in its debt management since a scare in 2024

Data

More articles

More articles

More articles

-

Despite better markets, few expect issuance volumes to recover from lowest levels in years

-

Pan-Baltic lender paid up to land its short dated MREL bond

-

Borrower may not care whether its offer is successful, said one analyst

-

New public credit head takes office with sovereign yet to complete external funding

-

Sovereign's bondholders preferred to keep longer dated bonds

-

Kenya has breathing room with no redemptions due until the summer of 2024

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa